You can make changes that streamline the process and improve efficiency by understanding how your manufacturing process works, what areas need improvement, and where bottlenecks exist. For example, working with a rare metal will make it more

You can make changes that streamline the process and improve efficiency by understanding how your manufacturing process works, what areas need improvement, and where bottlenecks exist. For example, working with a rare metal will make it more costly than working with a standard metal like iron or steel. They cost more to produce in bulk because there is less demand for rare metals.

You will be able to relocate or initiate manufacturing for your company in Mexico in a low-cost labor environment with very little delay or up-front costs. This means that it would be economically viable to produce

more bicycles, as long as the demand is there. At some point, however, the

marginal cost curve will turn upwards and each additional unit becomes more

expensive to produce than the previous one.

How to Calculate Predetermined Overhead Rate Machine Hours

This gives a better insight into cost and profit in real-time, helping to set more informed pricing. Along with many other manufacturing accounting metrics, total manufacturing costs can easily be tracked in an MRP/ERP system. Using this kind of software with a built-in manufacturing accounting system frees up managers’ time for activities that help actually grow the company. Taking a look at the total manufacturing cost is insightful for making your manufacturing company more cost-effective. While it is predominantly an accounting term, its utility can go far beyond balancing the books.

How do you calculate manufacturing cost?

The formula for calculating total manufacturing cost is quite simple. Total manufacturing cost = direct materials + direct labor + manufacturing overhead.

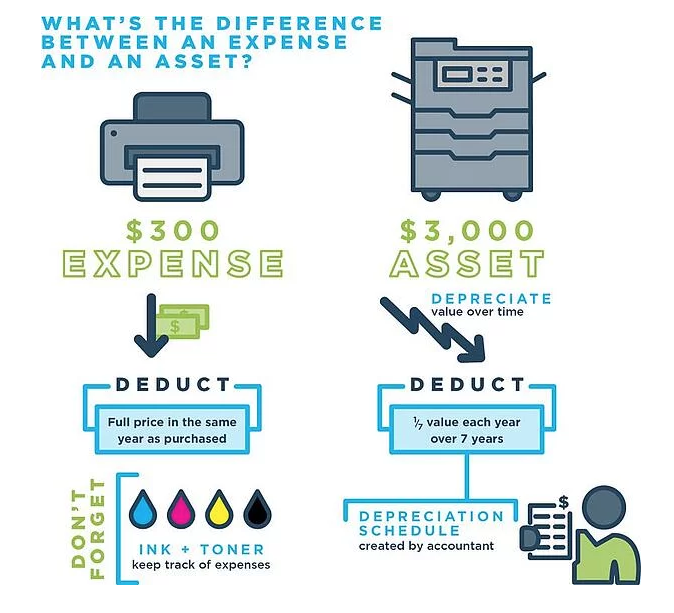

For example, if you were making a shirt, your direct manufacturing costs would include fabric, thread, and buttons for buttons. Indirect manufacturing costs cannot be traced directly to a single product but benefit multiple products or the entire company. These include depreciation and amortization for equipment, fixed wages for employees who work on several products, utilities, and property taxes. Direct materials cost is the cost of the raw materials that go into producing the finished product.

Manufacturing costs definition

For instance, if a business spends a given amount of funds on steel beams, these are direct material costs. In this case, the steel beams are physically manipulated to build the end product. Average cost (also called unit cost) refers to the costs

accrued with manufacturing one unit of a product. This is calculated by taking

the total cost (fixed costs + variable costs) and dividing it by the total

number of units produced. The total manufacturing cost is also used to calculate the cost of goods manufactured (COGM) as well as the cost of goods sold (COGS).

- Cutting back on energy consumption by going green can significantly bring down your overhead.

- It may take them a while to get the hang of all the features, and if they’re used to other systems, they might not understand how ABC works.

- When accounting for inventory, include all manufacturing costs in the costs of work-in-process and finished goods inventory.

- For example, if you’re making a wooden table, your direct materials would be wood.

- Total manufacturing costs could highlight expenses that are completely unnecessary (and can therefore be eradicated completely).

For example, if you’re making a wooden table, your direct materials would be wood. In this example, the total production costs are $900 per month in fixed expenses plus $10 in variable expenses for each widget produced. After subtracting the manufacturing cost of $10, each widget makes $90 for the business. Manufacturing overhead is any manufacturing cost that is neither direct materials cost nor direct labour cost. Manufacturing overhead includes all charges that provide support to manufacturing.

What Are The Three Categories Of Manufacturing Costs?

Now, you may be wondering, ‘wouldn’t this be covered in the general overhead cost’ not necessarily. You see In addition to the three most common manufacturing costs, you have expenses for the manufacturer’s supplies such as tools, tape, lubricants, and safety gear. Once you get a handle on your three largest manufacturing expenses, do an extensive audit of your facility to see where else you spend money that goes into your manufacturing costs.

What is the formula for manufacturing overhead cost?

Manufacturing Overhead Rate = Overhead Costs / Sales x 100

Depreciation on factory and machinery: $50,000. Depreciation on Graphix office building: $20,000. Property taxes on factory: $5,000.

The cost of transportation is increasing, putting a strain on manufacturing costs. Businesses can use the manufacturing cost to determine whether to produce or purchase a product, whether to add a new product line, or whether to discontinue a product. Manufacturing businesses calculate their overall expenses in terms of the cost of production per item. That number is, of course, critical to setting the wholesale price of the item.

Production Costs vs. Manufacturing Costs Example

The labor market is tight due to the growing demand for skilled workers in manufacturing. The demand for skilled workers has increased significantly over the last decade, outpacing the growth of other occupations. As a result, job seekers face a competitive landscape, particularly in their search for entry-level positions. Companies have to spend money on complying with financial vs managerial accounting these regulations and training their employees on how to comply. Second, those who work in manufacturing tend to be unionized and therefore have higher wages than non-union employees for similar jobs. This makes it more expensive for employers who do not provide benefits such as health insurance coverage or retirement savings plans (which most large companies do offer).

- The quality of raw materials can be the difference between a great product and a terrible one.

- You can use it to find out if you are hitting your targets or if your production process is conducive to your desired level of productivity.

- In this case, the company must purchase this machinery and train its employees to use it properly.

- In today’s fast-paced and competitive manufacturing environment, digital manufacturing has become an essential tool for improving total manufacturing cost management.

- In periodic inventory systems, where things are done manually or using spreadsheets, regular stocktakes need to be performed and material invoices summed up to get the numbers right.

Anything that isn’t directly tied to manufacturing or transporting your products. Digital manufacturing tools enable businesses to optimize the manufacturing process by simulating different scenarios and identifying the most efficient production methods. This optimization helps reduce the total manufacturing cost by minimizing waste, improving quality, and increasing productivity. Product costing is the process of determining the cost of producing a product. By understanding the manufacturing cost, businesses can accurately determine the cost of their products and set appropriate pricing strategies.

What is an example of a manufacturing cost?

In contrast, manufacturing costs fall into three broad categories – materials, labor, and overhead. For example, in production costs, the salary of the company accountant or the accountant's office supplies are included in addition to the salary and supplies of the foreman.